With each encounter a customer’s experience with your business changes and so do their expectations, the products they use, and which service delivery channels they rely on. Similarly, as a customer – business or consumer – moves through their lifecycle with your business the relevant management decisions reflecting business growth change. Broad based research or measurements that do not take into account both the customers journey and what management needs to know in order to make effective decisions will fail to deliver. Service experience management research that targets customers at each of the key stages of their life-cycle will deliver accurate, timely, and actionable insights that deliver a positive research ROI.

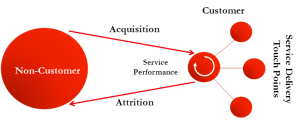

Shown below is an adapted systems model of the customer flow into and out of a business. At each key stage timely and relevant measurements need to be in place. In organisations where there are multiple products, and where resuscitation of ex-customers are a key parts of the growth strategy, these would need to be incorporated into the Service Experience Management measurement framework. While a larger customer service study may try to segment customers or even ask customers to recall their earlier experiences, this is less likely to give accurate results and likely to be more expensive that a more targeted approach.

A complete Service Experience Management programme includes relevant measurements at the four key areas of the customer lifecycle and service experience: Acquisition and on-boarding, lost customer, service delivery, and service performance stages of the customer lifecycle. While this approach may appear complex and expensive, its more focused design is simpler and often cheaper than an annual customer satisfaction survey or a service engagement survey that tries to address multiple issues and becomes too long. Below is a short description of each of the four key measurement areas and how they benefit your business.

- Acquisition On-Boarding. Research at this stage of the customer lifecycle includes both new customers and with high-value products, it often includes lost sales. This research covers needs to address four areas. First, it needs to understand what lead a customer to choose your business. This is used to help evaluate sales activity and coves information on what the previous provider they were with, or still with, and the potential role of intermediaries or contact staff. The second area is an evaluation of the service process associated with becoming a customer for service improvement. Third, their knowledge and interest in products and services your business offers to understand to assist with cross-selling. Finally, customer profiling information is needed to help forecast servicing and product needs. For example, for one client we found a growing proportion of customers were past customers, indicating a need to expand our marketing efforts beyond our traditional areas and the need more easily merge with their past customer data.

- Lost Customer. Is it something you are doing? Something your competitors are doing better? Maybe it is something out of your control. Sorting out the real reasons for attrition requires speaking to customers as soon as practicable after their decision was made and how different factors can interact to drive decisions. While in some industries identifying lost customers is easy – contract not renewed – in other industries the time between customer activity, the ability for customers to hold dormant accounts, or the time periods between leaving and closing registering the change, such as in education, may mean attrition research also needs to include low activity customers.

- Service Delivery. Service touchpoints are the service delivery moments of truth. These are the times of engagement when customers often judge the value of the service. For passive services like energy, insurance, and some banking products these touchpoints can become the sole basis of provider selection. Getting delivery right at these points of engagement involves not just getting what is delivered right but also the channel choice and consistency of service delivery across channels right. Actionable research at this stage requires fast timing and the ability to link changes in service and their support tools to the service delivery. Illustrating the importance of understanding the impact of internal systems on service delivery, for one telecommunications client changes in their training cycle of new staff created seasonal like patterns in service satisfaction.

- Service Performance. Service performance research in your service experience management system draws the focus on the underlying product performance. In some industries, this will be part of the service delivery research, and in others, it may be part of their brand tracking. The key role of this research is to ensure satisfaction with what is offered and its performance is accounted for in understanding customer behaviour. In banking research, this could include interest rates, and ATM access. In education, it could include courses offered and internships, while in not-for-profit it often includes awareness of how donations are spent. For a manufacturing client, the service product included training and promotional material.

Creating a 360 View of the Customer Experience

Targeting customers at each stage of their lifecycle with your business is done to ensure the information you capture accurately addresses the key business decisions at each stage and its impact on business growth: Acquisition, cross-selling, cost-management, and retention.

To create a programme that addresses each stage of your customer lifecycle does not need to be complex nor expensive. Instead, a disciplined approach that focuses on what is needed to understand customer behaviour, an understanding of business marketing and service activities, and regular reporting, can be more cost-efficient and help the business deliver improved service performance and growth.